|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

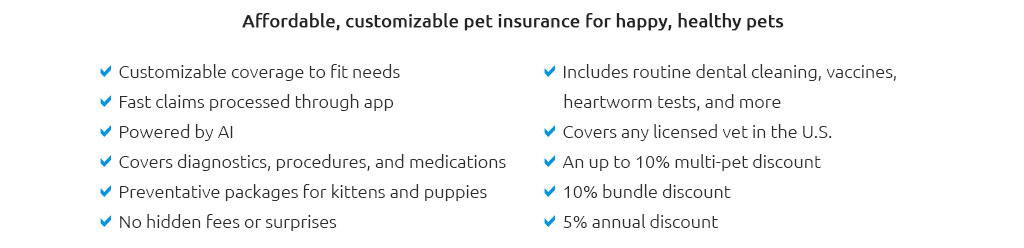

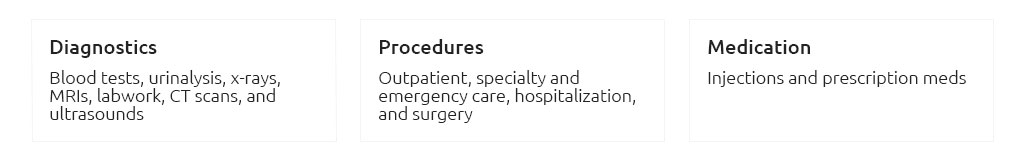

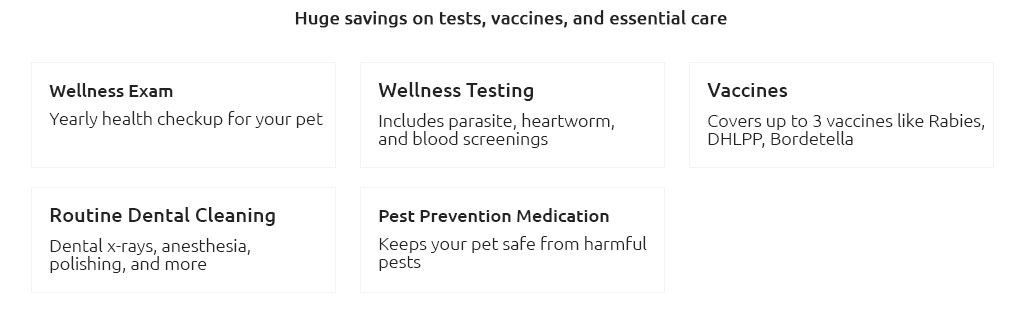

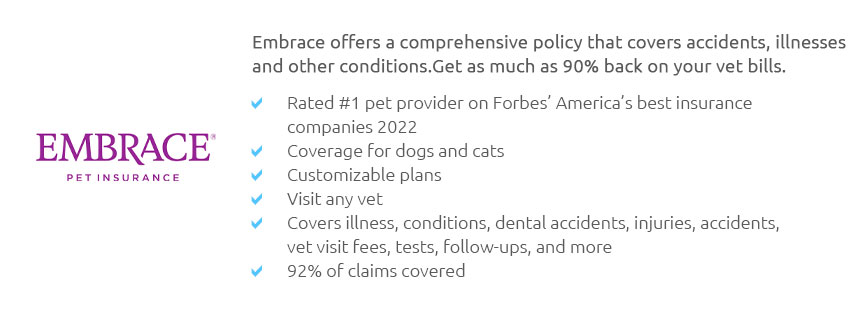

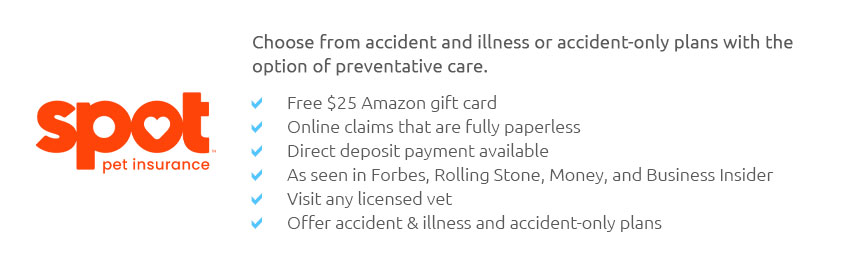

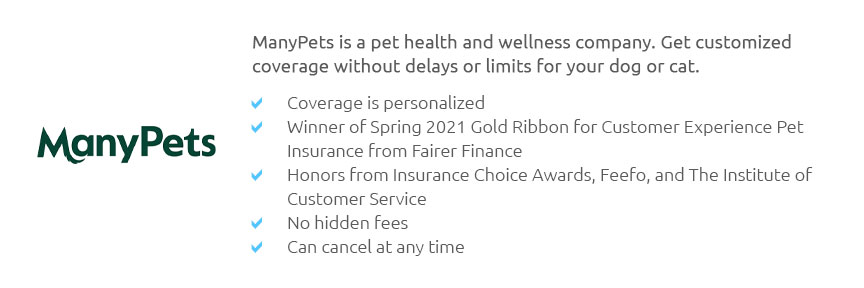

Understanding Pet Health Insurance for Cats: A Wise InvestmentIn today's world, where pets are cherished members of the family, ensuring their health and well-being is of paramount importance. Pet health insurance for cats has emerged as a crucial aspect of responsible pet ownership, providing financial security and peace of mind. But what exactly does it entail, and is it worth the investment? Let's delve into this topic with an open mind and explore the nuances of insuring our feline friends. Firstly, pet health insurance for cats works similarly to human health insurance, covering a range of medical expenses that may arise due to accidents, illnesses, or chronic conditions. The basic premise is simple: pet owners pay a monthly or annual premium, and in return, the insurance covers a percentage of veterinary costs, depending on the policy chosen. This concept has gained traction, particularly as veterinary medicine advances and the costs associated with it rise. The benefits of pet health insurance are manifold. One of the most significant advantages is the financial relief it offers during emergencies. Veterinary bills can quickly escalate, especially in critical situations, and having insurance can mean the difference between opting for necessary treatment or making difficult decisions based on cost. Moreover, many policies also cover routine care, such as vaccinations and annual check-ups, promoting proactive health management. When considering pet insurance for cats, it's essential to evaluate various factors to make an informed decision. Coverage options vary widely, and it's crucial to read the fine print. Some policies may cover only accidents, while others offer comprehensive plans that include illnesses and hereditary conditions. It's advisable to choose a plan that aligns with your cat's lifestyle and potential health risks.

While the concept of pet insurance is appealing, it's not without its critics. Some argue that it can be an unnecessary expense, particularly if one's cat is generally healthy and low-risk. However, the unpredictability of health issues makes insurance a prudent consideration for many. As the saying goes, it's better to have it and not need it than to need it and not have it. In conclusion, pet health insurance for cats represents a proactive approach to pet care, offering financial protection and supporting the health of our beloved companions. By carefully selecting a policy that suits your cat's needs and your financial situation, you can ensure that your feline friend receives the best possible care, regardless of life's uncertainties. After all, the peace of mind that comes with knowing you're prepared for the unexpected is invaluable. https://www.healthypawspetinsurance.com/cat-and-kitten-insurance

The Healthy Paws Pet Insurance plan covers your cat from nose to tail. It pays on your actual veterinary bill and covers new accidents and illnesses, ... https://www.statefarm.com/insurance/pet/cat-insurance

Trupanion covers eligible veterinary care expenses, based on your policy, for your cat or kitten. You are responsible for any non-eligible expenses. Eligible ... https://www.statefarm.com/insurance/pet/cat-insurance

Trupanion covers eligible veterinary care expenses, based on your policy, for your cat or kitten. You are responsible for any non-eligible expenses. Eligible ...

|